ENBD REIT invests in a wide range of properties, with a primary focus on the UAE, with the aim of providing consistent income generation to shareholders. Prior to listing on Nasdaq Dubai, Emirates Real Estate Fund, the predecessor to ENBD REIT, had since inception in 2005 provided investors with a regular and stable source of income by way of annual dividends (with limited exceptions) and long-term capital appreciation in net asset value per share.

ENBD REIT's current portfolio consists of eleven properties, located in Dubai in the office, residential and alternative sectors The portfolio includes the following properties:

The REIT aims to regularly distribute a dividend with a target of achieving a total return of approximately 5% per annum. In addition, the Fund Manager focuses on enhancing the value of ENBD REIT's assets.

The REIT's investment strategy is designed to take advantage of current and projected market conditions within the UAE. The Fund Manager believes that steady economic growth in the UAE will set the stage for continued improvement in the country's real estate market.

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 30th Sep 2025 | USD 419m | USD 243m* | USD 0.97* | USD 0.0204 | 4.21% | 8.16% | USD 0.50 |

| 30th Jun 2025 | USD 411m | USD 237m* | USD 0.95* | - | - | - | USD 0.56 |

| 31st Mar 2025 | USD 395m | USD 219m* | USD 0.87* | USD 0.0200 | 2.48% | 3.66% | USD 0.55 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 31st Dec 2024 | USD 394m | USD 216m* | USD 0.86* | - | - | - | USD 0.35 |

| 30th Sep 2024 | USD 379m | USD 202m* | USD 0.81* | USD 0.0200 | 2.51% | 6.08% | USD 0.33 |

| 30th Jun 2024 | USD 387m | USD 199m* | USD 0.80* | - | - | - | USD 0.35 |

| 31st Mar 2024 | USD 384m | USD 195m* | USD 0.78* | USD 0.0160 | 2.05% | 4.57% | USD 0.35 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** ** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 31st Dec 2023 | USD 384m | USD 191m* | USD 0.76* | - | - | - | USD 0.37 |

| 30th Sep 2023 | USD 379m | USD 189m* | USD 0.76* | USD 0.0140 | 1.85% | 3.59% | USD 0.39 |

| 30th Jun 2023 | USD 375m | USD 183m* | USD 0.73* | - | - | - | USD 0.39 |

| 31st Mar 2023 | USD 370m | USD 179m* | USD 0.72* | USD 0.0180 | 2.51% | 4.64% | USD 0.39 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** ** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 31st Dec 2022 | USD 365m | USD 173m* | USD 0.69* | - | - | - | USD 0.39 |

| 30th Sep 2022 | USD 363m | USD 172m* | USD 0.69* | USD 0.0180 | 2.61% | 4.38% | USD 0.41 |

| 30th Jun 2022 | USD 357m | USD 166m* | USD 0.66* | - | - | - | USD 0.43 |

| 31st Mar 2022 | USD 356m | USD 167m* | USD 0.67* | USD 0.0200 | 2.99% | 4.65% | USD 0.43 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** ** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 31st Dec 2021 | USD 357m | USD 168m* | USD 0.67* | - | - | - | USD 0.46 |

| 30th Sep 2021 | USD 346m | USD 164m* | USD 0.66* | USD 0.0180 | 2.74% | 4.09% | USD 0.44 |

| 30th Jun 2021 | USD 351m | USD 174m* | USD 0.70* | - | - | - | USD 0.44 |

| 31st Mar 2021 | USD 360m | USD 180m* | USD 0.72* | USD 0.0176 | 2.44% | 4.10% | USD 0.43 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** ** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 31st Dec 2020 | USD 366m | USD 184m* | USD 0.74* | - | - | - | USD 0.43 |

| 30th Sep 2020 | USD 377m | USD 198m* | USD 0.79* | USD 0.0194 | 2.44% | 6.26% | USD 0.31 |

| 30th Jun 2020 | USD 393m | USD 215m* | USD 0.86* | - | - | - | USD 0.34 |

| 31st Mar 2020 | USD 410m | USD 230m* | USD 0.92* | USD 0.0204 | 2.22% | 5.73% | USD 0.36 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** ** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 31st Dec 2019 | USD 429m | USD 246m* | USD 0.98* | - | - | - | USD 0.48 |

| 30th Sep 2019 | USD 435m | USD 254m* | USD 1.02* | USD 0.0196 | 1.93% | 3.64% | USD 0.54 |

| 30th Jun 2019 | USD 437m | USD 255m* | USD 1.02* | - | - | - | USD 0.52 |

| 31st Mar 2019 | USD 450m | USD 270m | USD 1.08 | USD 0.0215** | 2.00% | 3.81% | USD 0.57 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** ** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 31st Dec 2018 | USD 456m | USD 284m | USD 1.11 | - | - | - | USD 0.64 |

| 30th Sep 2018 | USD 459m | USD 285m | USD 1.12 | USD 0.0270 | 2.41% | 3.60% | USD 0.75 |

| 30th Jun 2018 | USD 463m | USD 289m# | USD 1.14# | - | - | - | USD 0.81 |

| 31st Mar 2018 | USD 463m | USD 300m* | USD 1.18 | USD 0.0129 | 1.09% | 1.30% | USD 0.99 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** ** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

| Date | Property portfolio value |

NAV | NAV per share | Dividend per share |

Dividend % on NAV* |

Dividend % on Share Price |

Share Price |

|---|---|---|---|---|---|---|---|

| 31st Dec 2017 | USD 460m | USD 300m | USD 1.18 | - | - | - | USD 0.99 |

| 30th Sep 2017 | USD 353m | USD 295m~ | USD 1.16~ | - | - | - | USD 1.00 |

| 30th Jun 2017 | USD 352m | USD 302m* | USD 1.18 | USD 0.0382 | 3.24% | 3.86% | USD 1.08 |

| 31st Mar 2017 | USD 315m | USD 297m | USD 1.17 | - | - | - | USD 1.17 |

* NAV stated cum-dividend

~ Dividend payment made in this period

# Dividend payment and return of capital made in this period (totaling USD 12,007,743 or USD 0.0472 per share)

** ** Final dividend for FYE 31st March 2019, approved by shareholders on 24th June 2019 and subsequently paid on 15th July 2019

*Source: Emirates NBD AM, A Share Class, bid to bid, USD terms with net income reinvested including capital distribution

| 12 month return | 4.80% |

| 24 month return | 13.06% |

| 36 month return | 29.65% |

| 48 month return | 44.59% |

| 60 month return | 57.46% |

| Since Inception | 32.11% |

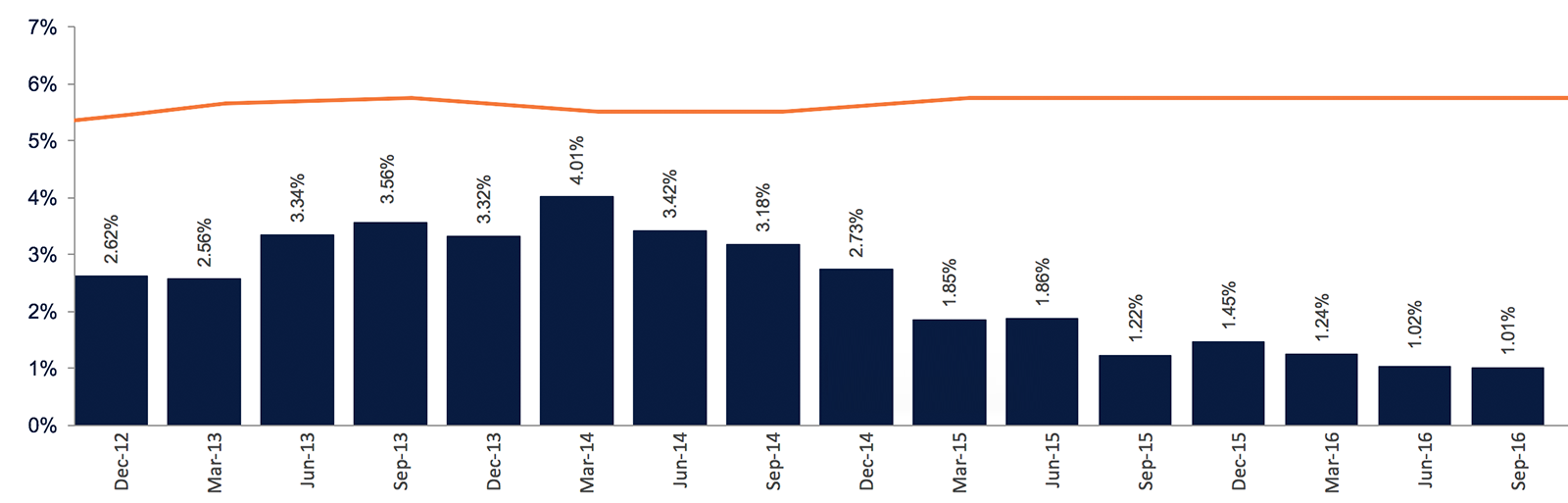

*Source: Emirates NBD AM, Emirates Real Estate Fund A Share Class, bid to bid, USD terms with net income reinvested including capital distribution, as at 30th September 2016.